The real risk to the Philippines contact centre industry

With the increasing deployment of automation and customer preferences to self-serve the Philippines contact centre industry expects to lose 43,000 jobs over the next 5 years.

This represents a 29% decrease in the number of people employed in “low-skilled call centre jobs that require little abstract thinking or autonomy” according to a report in the inquirer.net.

But according to Jojo Uligan, president of the Contact Centre Association of the Philippines, it’s not all bad news.

Uligan is still predicting 8% annual growth in the industry until 2022 increasing revenue from $12.8B last year to $20.4 in 2022.

Rather than just accept that technology is eventually going to decimate the industry, Uligan says “We’re focused on upgrading our workers. So those with jobs which are defined as simple, it doesn’t mean we’re going to take them out. We’re going to train them so they can start accepting more complex types of work.”

This move to more complex work is expected to see the addition of around 73,000 jobs according to Uligan.

The cracks are starting to appear

It’s only natural for Uligan to promoting the virtues of the Philippines contact centre industry.

And whilst the 8 per cent growth forecasts sounds great, an article by Bloomberg suggests The Worlds Top Call-Centre Nation Has a People Problem.

Bloomberg suggested that with previous growth rates in excess of 10 per cent in the past, this in itself, is an acknowledgement that things are on the decline.

Uligan was also quoted as saying companies were increasingly seeking workers who were college-educated, experienced, had technical expertise and could easily be retrained.

“There is a lot of complex work now. It’s no longer mere directory assistance or taking orders,” he said. “People don’t evolve as fast as technology.”

In August 2020, Telstra went public with their intent to remove all overseas call centre jobs and handle all inbound calls back in Australia.

Their CEO, Andy Penn was quoted as saying “By the end of 2020 financial year, over 71% of its service transactions happened via digital channels, up from 53% at the end of FY19” and their goal is that by 2022, they will have reduced over two-thirds of their call volumes to the call centre.

Preparing for Automation

Sitel Asia-Pacific CEO Craig Reines acknowledges the shift in customer requirements and said “Call centre agents will be ‘retooled’ to work with chatbots and other forms of artificial intelligence”.

If you’ve got the time there is a 16-minute video you can watch on the CCAP website.

While mechanical tasks will be automated, agents will still be on hand to provide the human touch that the Philippine outsourcing industry is known for, Reines told ANC’s Early Edition.

“It doesn’t do emotion well,” Reines said of AI. “It becomes very stale, very boring. It doesn’t provide that wow customer experience.”

Reines said digital-savvy Filipino BPO workers were poised to take advantage of the industry’s shift to AI:

“We view it as a huge opportunity. One of the tremendous advantages of the Philippines is you have a really unique service-oriented workforce.”

Beyond Automation

The strategy to foresee the impact of technology and up-skill your workers is no doubt the right move and not just for the Philippines, that technology freight train is coming to call centres no matter where in the world you are.

But personally, I think there are far greater threats

I’m no economist but from my experience, the increasing labour rates, inflation and the fluctuating (tanking?) Australian Dollar is poised to have a huge impact when it comes to the benefits of offshoring from Australia to the Philippines.

Inflation

The Philippines inflation rate peaked in September 2018 at a rate of 6.7 per cent, representing a 9 year high and the highest reading since Feb 2009.

As you can see in the chart below, this has dropped considerable over 2019 and has started to creep up again in 2020.

Today the average cost of a fully outsourced call centre agent in the Philippines is around $8 – $12USD which equates to $11 – $16.50 AUD per hour.

This includes accommodation, management, technology and of course the profit for the outsourcer included.

As a reminder, the minimum award rate in Australia for a level one call centre worker (as of August 2020) is $21.54.

Already I’ve heard isolated examples that top call centre agents in the Philippines could earn in excess of $20 USD per hour which based on exchange rates at August 2020, is $27.72 AUD.

That figure, however, has been disputed by many, with the acceptance that $15 USD ($20.79 AUD) for the very top local talent more palatable.

These figures certainly aren’t the norm though.

Currently, an agent is more likely to receive a monthly salary of around 20,000 Peso or around $500AUD per month.

But like anywhere, where there is competition the cream rises to the top and high performing agents can and will demand higher salaries, conditions etc especially when inflation is also on the rise.

With competition for great staff increasing, and with shrinking headcounts due to automation, the squeeze on outsourcers profit margins will continue to tighten.

This then opens up the opportunity for other countries like South Africa, Fiji or the Dominion Republic where salaries are still lower, or with lower inflation, to push their wares for the lucrative contact centre industry dollars.

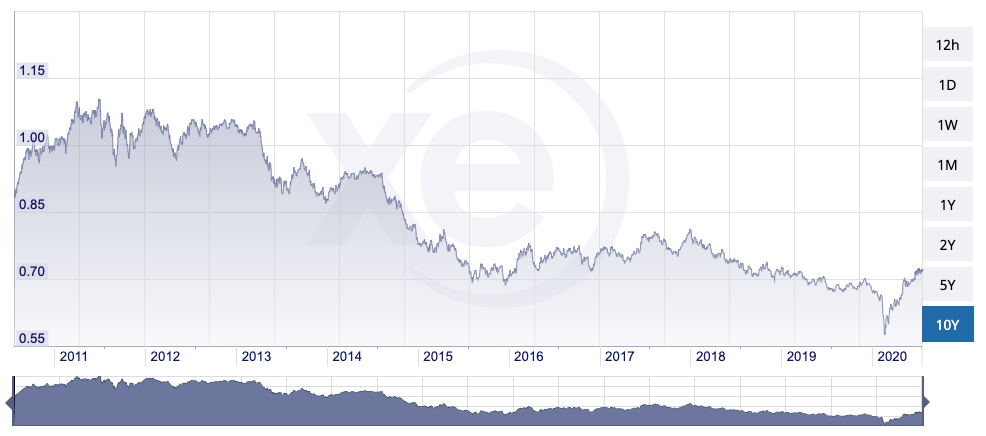

Australian Dollar

For the majority of call centre operations in the Philippines, payment for services is in USD.

And unless you’ve been blissfully avoiding the news of recent times, the Australian Dollar is not travelling well.

From a ‘high’ of $1.101 on 1 August 2011 down to $0.57409 on 20 March 2020 is a 48% decrease!

This, of course, makes it a lot more expensive for Australian businesses using Philippines call centre outsourcers.

But with COVID hitting and changes to the global economy, we are seeing the AUD strengthen in 2020.

The dilemma for Australia Businesses

Regardless of the location, if you’re not saving significant dollars by offshoring why would you do it?

It’s certainly not to improve the customer experience.

With the aforementioned technology eliminating or reducing the basic enquiries it’s essentially leaving the more complex calls that need to be handled by a live operator.

Yes, you can upskill the workers, but as I’ve outlined in my article ‘Does the call centre location really matter‘, one of the key frustrations for customers when dealing with offshore call centres is that the ability to communicate becomes just that little bit harder.

And as the calls become more complex, so does the potential risk for communication challenges.

Don’t get me wrong, even with the lousy Australian dollar and relatively high inflation in the Philippines it’s still a much cheaper proposition than having your call centre in Australia.

And that’s going to be the dilemma for local business.

Summary

It seems clear (to me) that the whole value proposition for the Philippines contact centre industry is changing with specific regards to call centre outsourcing from Australia.

The factors the industry can control are already in play – upskilling the agents, investing in technology etc.

But it’s the other factors that may end up playing a larger role.

As per usual, keen to hear your thoughts.

Footnote:

Wow, did I get this wrong!

Back in 2017 when I first wrote this no one could have predicted the impact COVID would have on the world.

With specific regards to the Philippines contact centre industry, the impact was devasting.

Many contact centres were forced to close as staff were unable to attend due to lockdowns.

As a result, many large Australian businesses were left stranded as they had placed their proverbial eggs in the one basket and were left with no immediate way to handle customer enquiries.

Contact centres (or work from home agents) were quickly mobilised in Australia and many organisations have now signalled their intent to now keep their contact centres onshore regardless of how the pandemic progresses.

This will, in turn, impact the Philippines contact centre industry with less available jobs that combined with the pressures raised above, may see a significant shift in their dominance in the global contact centre distributions.

Having spent some time consulting in the Philippines, my experiences were overwhelmingly positive in the many centres I visited so I wish everyone well and hopefully, we all get through this together.

Need some help with your offshore contact centre strategy?

- Search a list of BPOs in the Philippines for front office (e.g. call centre) or back office (e.g. accounts payable, data entry etc)

- Search a list of consultants who can help with your offshore contact centre strategy >

- Read more: Reshoring call centres back to Australia is on the rise >