Medibank customer service overhaul is underway

In a CMO article way back in 2016, the then-new Medibank CEO Craig Drummond announced a Medibank Customer service overhaul in response to increasing customer frustration and the resultant customer churn.

One particular pain point noted in the article is the poor contact centre experience with wait times “doubling from three minutes to six minutes in the past six months”.

According to some customers, however, even that is a little optimistic – one customer commented that “Medibank is still in denial. Drummond is either lying or being lied to. Telephone waiting times are 30 to 60 minutes, not 3 to 6 minutes”.

Ouch.

Unfortunately, reference and data to customer wait times via the contact centre seem to have mysteriously been removed from the Medibank annual reports with the last mention back in 2017 when “the average call wait time in our customer service centre dropped significantly”.

In 2020, Medibank also introduced Messaging – their online char service that “allows customers to reponson to a conversation in their own time along with other ‘self-service features to make it simple for customers to get what they need.

Perhaps it seems unless what they need is to speak to a live customer service agent without a long wait time?

Net Promoter Score

In addition to updating some infrastructure in a $150m project back in 2016, Drummond also announced plans to introduce Net Promoter Scores (NPS) across the organisation.

The program has been in place since 2017 and the NPS scores have steadily improved:

| Net Promoter Scores (NPS) | |

| 2017 | +1.5 |

| 2018 | +15.3 |

| 2019 | +24.8 |

| 2020 | +31.8 |

Source: Medibank Annual Reports

AHM appears to be doing a little better however with the 2020 NPS results +41.2 compared to Medibanks +31.8

Medibank CEO admits customer experience failings

Editor: note this is from the 2016 article:

Medibank’s number one priority must be to prioritise customers’ needs and outcomes if it’’s to restore brand trust and halt member attrition, its CEO says.

The private health insurance giant announced its full-year results today, reporting a group net profit of $417.6 million, up 46.4 per cent year-on-year, as well as an increase in operating profit to $510.7m.

Despite these solid results, it was evident throughout the financial report and statements that Medibank’s brand is struggling to relate to modern customers, and the group has seen its market share in terms of policyholders decline in recent years.

In particular, challenges include negative perceptions around lack of customer centricity and value for money, the group stated.

“While Medibank has paid $5.1 billion in claims this year on behalf of our customers, some challenges remain with the value we offer to our customers,” its newly installed CEO, Craig Drummond, said. “

What is clear is that we need to put our customers at the centre of everything we do.

Customers’ needs and outcomes have to be our number one priority.” Of most importance is putting customers at the heart of every decision the group makes, Drummond said.

He admitted customer service, experience and value is not where it needs to be for Medibank.

“We have to halt customer attrition in the Medibank brand,” he said. “

To do this, we know we have to get the basics right – we have to build trust and simply do a better job for the customer.”

Drummond noted several organisational pain points and strategies impinging on the efficient and effective delivery of Medibank’s offering.

These must be addressed in order to remove primary customer friction points. “

We have identified these primary frustration points and the accountable executives inside the company to fix them,” he said. “

These will be fixed methodically and with a new sense of urgency.”

Further Investment

In November 2016, Medibank’s Chief Customer Officer announced a further $6M investment that includes, amongst other things, a 205 increase in staffing levels for the Melbourne based contact centre.

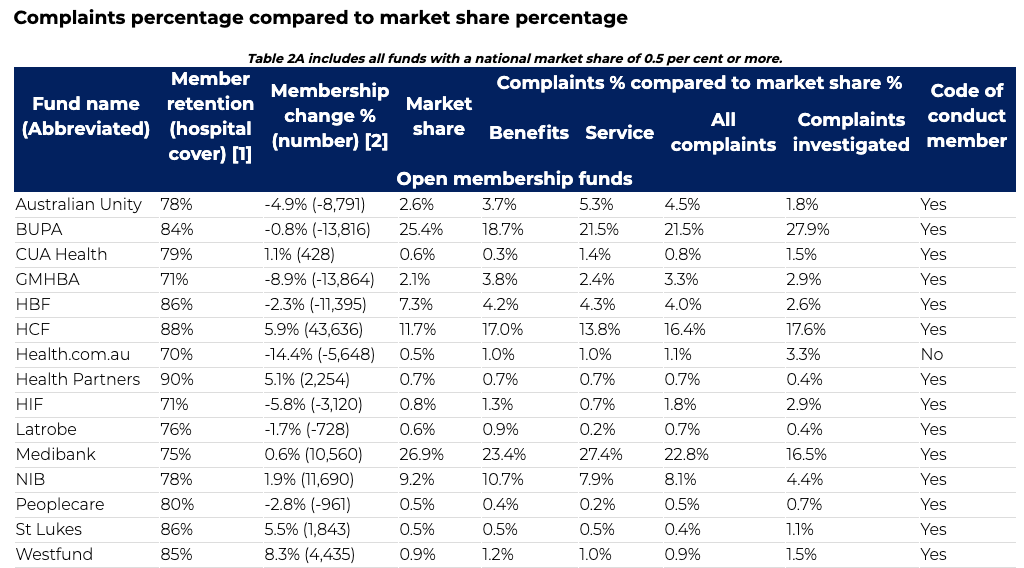

It would appear that the investment in starting to pay off, in July 2017 Medibank announced that it was ” pleased to see the improvements it has made for its customers reflected in its falling share of Private Health Insurance Ombudsman industry complaints – down by more than a third, from 60.7 per cent in September 2016, to 37.8 per cent in the latest quarter”.

Initiatives specifically related to the call centre included:

- Reducing its average call wait time from 6 minutes to 3 minutes and falling

- Hiring 60 additional contact centre employees

- Launching 24/7 online customer service and opening contact centre on Saturdays

- Launching a new and improved version of its app

There is still some way to go through.

In a 2018 Commonwealth Ombudsman report, Medibank (AHM) received the most complaints for all Health Insurance Providers although the percentage of disputes was significantly better than their main Competitor BUPA (12.5% compared to 30.8%).

Fast forward to 2020 and not much appears to have changed with Medibank still receiving the most amount of complaints according to the Commonwealth Ombudsman although in the 2020 Medibank Annual Report, they are still claiming it as a win citing “our share of industry complaints remains consistently below our market share”.

Recommended further reading: 15 Tips for improving your customer service

- Need help in improving your customer experience? Search the free CX Industry Business Directory for suppliers who specialise in CX improvement including technology suppliers, consultants, Mystery Shopping companies and more.

- Learn the skills to improve Customer Experience in your business. Search our CX Skills website for upcoming CX courses >

Be the first to comment